Online reporting tools to streamline reconciliation

With AffiniPay, you get detailed transaction information and daily deposits of all member payments, with no fees deducted until the beginning of the following month and automated transaction uploading to QuickBooks Online.

Our customizable reports and dashboards offer on-demand access to real-time payment statistics and important business metrics that can help you better manage your organization's finances and more accurately forecast future cash flow. Plus, our system is designed specifically to make both reconciliation and audit preparation easier and more efficient.

Reporting and Reconciliation

View valuable financial data, create custom reports, and streamline reconciliation

AffiniPay gives associations, nonprofits, and professional societies everything they need to track transaction activity, prepare for audits, and simplify reconciliation—all in one place.

Our flexible online reporting tools empower you to organize and analyze payment information in the way that best supports your reporting needs.

- Utilize unlimited custom data fields to automate reconciliation and include details like GL code or member name/ID with each transaction

- Quickly generate detailed reports for board members and auditors using custom tags or export data to create more complex reports

- Receive full daily deposits of funds, with all processing fees debited at once the following month to make reconciliation clean and straightforward

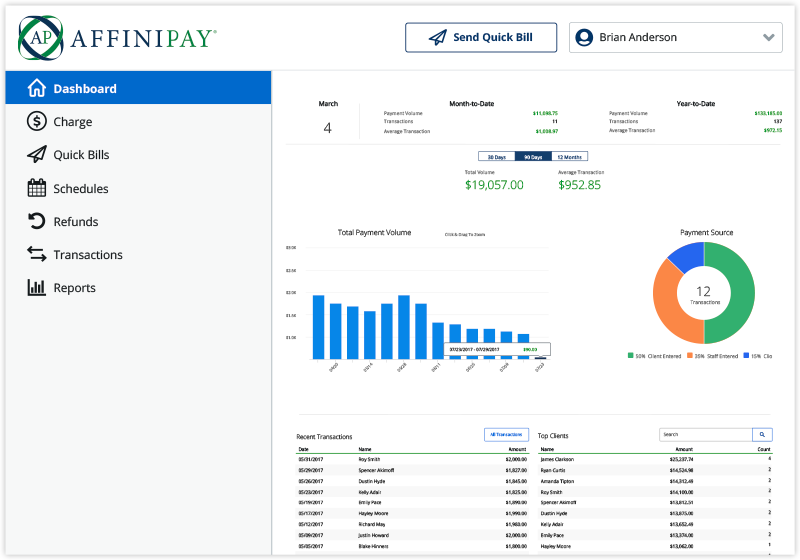

Dashboard

Evaluate your organization's current financial standing and performance over time

Our payment dashboards allow you to see essential short- and long-term payment statistics and key business metrics at a glance.

With this insight, you can more easily assess the financial health of your organization, better manage finances, and more accurately project cash flow.

- Track seasonality and identify common payment trends to pinpoint opportunities to increase revenue

- Leverage historical data to guide your decision-making and more effectively plan for the future

- Create visual representations of progress towards strategic financial goals to share with committee members and stakeholders

PCI Level 1 compliant technology

In-house support team of payments experts

15+ years payment industry experience